Q2 Qualcomm Update. Ushering in the Windows age of ARM

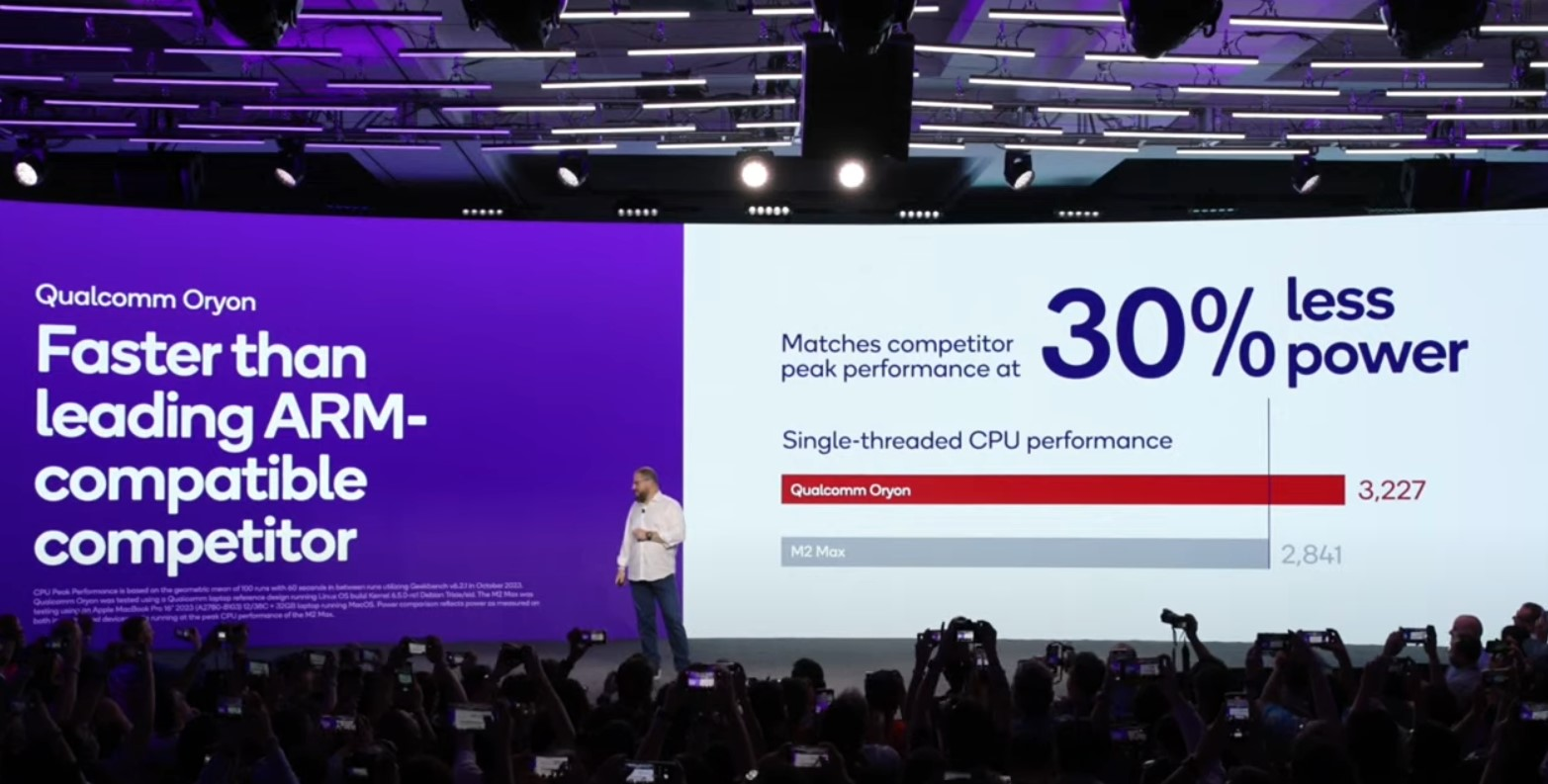

Since the prior post on 18th January, Qualcomm has shot up 45%. Now making all new time highs. It is not surprising, giving the stock was not expensive, and major OEM's had signalled positive reception to the latest SOC, a chip which will power Windows notebooks, with comparable, if not superior performance to Apple's M2 Max.

This chip was specifically developed for Windows, in collaboration with Microsoft. Microsoft knows the major weakness of Windows notebooks are the inferior battery life, and loud fan, in comparison to Macbooks. What's more, Windows x86 Machines perform poorly with creative applications such as the suite of products offered by Adobe. Professionals tend to opt for Apple hardware for these applications. Adobe announced they will make Adobe products native to Windows running on a Qualcomm Snapdragon X Elite (Oryon).

Now, I do not know how many Oryon SOC's Qualcomm has taken order for. But we do know many of the major OEM's have taken orders. This may signal the start of the Notebook transition away from x86. As with all trends, it will be exponential. It will look like a tiny dent in the x86 Market, perhaps 1%. then creep to 2%, 4%, 8%, 16%, 32% etc.

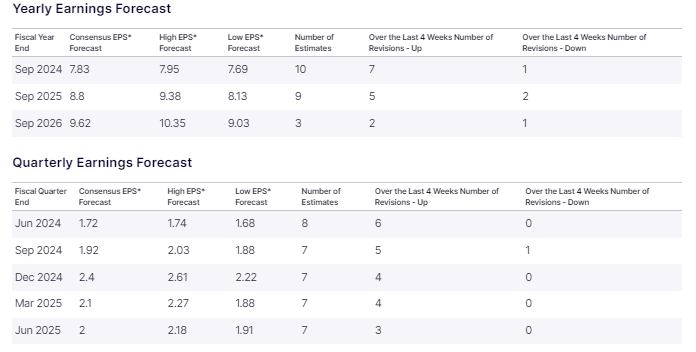

Qualcomm is in line for a higher earnings multiple, if it can demonstrate sustainable growth into the Windows Notebook market. Even if the intial dent is not significant, consistent growth will demonstrate Windows ARM will prevail, and the Market may assume at some point Qualcomm will consume the whole x86 Notebook market and go FOMO!

If I were not on board at this point, I would aim to buy in the $190-$200 range as I do not believe it will get any lower, given $190 was major resistance, and is now major support. As for position size, buy approximately half to 2/3rd's the amount one would have brought when the stock was trading in the $140 range.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with a regulated financial advisors before engaging in any trading activities.